The reason digital financial is more than just a mobile or on-line system is that it includes middleware remedies. Middleware is software that bridges operating systems or data sources with various other applications.

Over 60% of consumers now use their smartphones as the preferred method for electronic financial.

This dynamic forms the basis of client fulfillment, which can be nurtured with Consumer Partnership Administration (CRM) software program. Therefore, CRM has to be incorporated right into a digital financial system, given that it offers methods for banks to straight interact with their consumers. There is a demand for end-to-end consistency and also for services, maximized on ease as well as user experience.

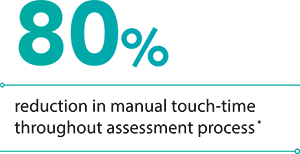

One means a financial institution can enhance its back end business performance is to split hundreds of procedures into 3 categories: full automatic partly automated hands-on tasks It still isn't functional to automate all procedures for lots of monetary companies, specifically those that carry out economic reviews or offer financial investment suggestions. Yet the even more a financial institution can change cumbersome repetitive guidebook jobs with automation, the extra it can concentrate on concerns that include direct interaction with consumers.

What specifically is "electronic banking," as well as what does it suggest for your financial resources? The details below can help you stand up to speed up on what electronic financial is, what it consists of and various other new terminology you may have listened to in discussions regarding digital financial. You'll additionally be able to check out the benefits of electronic financial and just how it affects the method you bank today as well as tomorrow.

methods using an application to access a number of those very same financial features via mobile gadgets such as smartphones or tablets. These applications are proprietary, released by the financial institution where you hold your account, as well as usually utilize the exact same login details as your on the internet financial site. Designed for people on the go, mobile banking apps often tend to consist of the most used banking features, such as mobile check down payment, funds transfers and expense settlement.

Banks likewise may utilize their mobile applications to send consumers banking signals such as fraud detection and reduced equilibrium alerts. Below's an aesthetic equation that sums up (essentially) electronic financial: Online Financial + Mobile Financial = Digital Banking Online banking in sandstone houses the U.S. has its origins back in the 1990s.

Who Uses Digital Banking? You can locate digital banking through 2 key sources: brick-and-mortar financial institutions and lending institution, and on the internet financial institutions. Neither resource is much better than the other. Rather, some customers might locate one to be a far better fit than the other for their requirements. Digital Banking Via Brick-and-Mortar Financial Institutions For consumers who appreciate the ability to stop by a branch to execute a few of their banking functions, brick-and-mortar financial institutions and also lending institution are the natural choices for their checking account.

On the internet financial institutions can take numerous kinds, every one of which challenge the high charge, low return brick-and-mortar financial version. Sometimes, they might be affiliated with a conventional brick-and-mortar financial institution, acting as its online division. Or they might operate exclusively online. More current fintech models have actually included what are described as neobanks or challenger banks.

With an extra structured, on-line and also mobile-only product offering, these banks can decrease operational costs and also aid more individuals gain access to financial solutions, a potentially huge advantage to the underbanked and unbanked communities. You may discover that some on the internet financial institutions may not issue car loans or charge card, as a means to reduce their threat.

Small service owners and start-ups can access a number of different online company financial institutions developed for their needs, placing the ideal company banking experience as close as your desktop computer or mobile device. What Are the Perks of Digital Financial?

If you rely solely on an on the internet bank, you can be challenged to access your accounts should your financial institution experience an online or mobile app outage and there's no branch for you to see instead. For those that aren't tech-savvy, on-line financial and also mobile financial apps could be a little bit much to digest.

You'll desire to understand which monetary institution an on-line bank is partnered with to guarantee that your down payment funds are guaranteed. If you can not easily find this info, you may desire to look for one more on-line bank.